I was unfamiliar with the Index of Economic Freedom but, after a little research, discovered that it is a multicomponent rating of major economies by the slightly right-leaning Wall Street Journal and very right-leaning Hertage Foundation. As with any composite metric, the devil is often in the details of the individual subcomponents but let's assume that this is a worthwhile scoring system (at least from the perspective of those who believe in smaller government / less public economic intervention) and dig in.

Indeed, according to both the Wikipedia article and the Heritage Foundation site, the US was ranked #11 worldwide this year, so we can rate this claim as TRUE.

However, the US was ranked #12 in 2015 and 2014 so we can rate the claim that #11 is its worst ranking ever as FALSE.

Given its ranking improvement from 2015 to 2016 and its flat ranking from 2014 to 2015 (as well as 2012 to 2013), we can also rate the claim that the US's ranking has declined seven times in the most recent 8 years as FALSE. (Possibly the author meant to refer to the US's decline in score rather than ranking.)

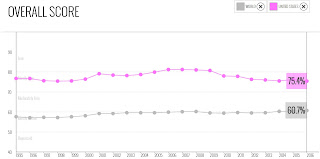

Indeed, the US's decline from a brief high of 81.2% to its current 75.4% does mark a shift from the first tier ("Free") to the second tier ("Mostly Free") so we can rate this claim as TRUE (although the 80% boundary between the two tiers seems to be somewhat arbitrary).

The author is batting .500 in his claims so far but, rather than discrediting him, let's look at the actual data to see what it tells us. From 1995 to 2008 the US's ranking in the Index of Economic Freedom bounced between #4 and #8. From 2012 - 2016 it has bounced between #10 and #12 so there has indeed been a decline in rankings over the course of the Obama administration. What could explain such a decline?

- a change in ranking methodology

- a rise in the scores of other countries

- a decline in the US's score

I think we can dismiss #1 as Hong Kong and Singapore have been #1 and #2 respectively ever since the Index of Economic Freedom was first assessed in 1995. If there had been a substantial change in methodology, I suspect that we would have seen a shake-up at the top.

As you can see from the above graph, the average score of other countries has increased modestly over time while the US's is at around the same score it had in 1995. The US's score increased during the Bush administration and has decreased during the Obama administration. Assuming the score responds rapidly to changes in policy and assuming that it isn't just a partisan propaganda machine for its right-leaning benefactors (I don't know how safe either of those assumptions are.), let's dive into its subcomponents to see why the score has fallen in recent years.

- Business Freedom: A country's freedom from the burden of regulations on starting, operating, and closing business, given factors such as time, cost and number of procedures, as well as the efficiency of government in the regulatory process.

- This subcomponent is in line with historic averages - although there was a big blip upward in 2006, possibly due to a methodology change.

- Trade Freedom: Freedom from sizeable numbers and burdens of tariffs and non-tariff barriers to imports and exports of a country.

- This subcomponent has steadily improved.

- Fiscal Freedom: How free is a country from tax burden. It comprises three quantitative measures: top marginal tax rate of both individual (1) and corporate (2) income, and total tax burden as a percentage of GDP (3).

- This subcomponent has been flat while the rest of the world has improved.

- Government Size/Spending: Governments' expenditures as a percentage of GDP, including consumption and transfers. The higher the percentual spending, the lower the score.

- This subcomponent has decreased since 9/11 but has increased again since 2012.

- Monetary Freedom: How free from microeconomic intervention and price instability is a country, basing on an equation considering the weighted average inflation rate in the last three years and price controls.

- This subcomponent has decreased over time.

- Investment Freedom: Freedom from restrictions on the movement and use of investment capital, regardless of activity, within and across the country's borders.

- This subcomponent has been flat except for a blip up during the late 2000s.

- Financial Freedom: A country's independence from government control and interference in the financial sector, including banks. It considers government ownership of financial firms, extent of financial and capital market development, government influence on the allocation of credit and openness to foreign competition.

- This subcomponent has been flat except for a blip up during the Bush administration.

- Property Rights: Degree of a country's legal protection of private property rights, degree of enforcement of those laws, independence of and corruption within the judiciary, and likelihood of expropriation.

- This subcomponent has slightly decreased over time - along with the rest of the world.

- Freedom from Corruption: The non-prevalence of political corruption within a country, according to the Corruption Perceptions Index.

- This subcomponent has been flat since 1997.

- Labor Freedom: How free is a country from legal regulation on the labor market, including those relating to minimum wages, hiring and firing, hours of work and severance requirements.

- This subcomponent has been flat but took a big dive this year (not sure why).

CONCLUSION (at least from these metrics): the US government is a little bigger and a little more regulatory than it was under Bush and about the same as it was under Clinton but has not changed much in 21 years. If you believe in smaller government, you won't be thrilled with the US's performance in the Index of Economic Freedom - but it would be hard to point to it as evidence of Obama's total economic failure.

No comments:

Post a Comment