As part of my series analyzing the article suggesting that Obama has changed the economy for the worse, let's now move on to the fourth claim: that Obama has accrued more debt than all other presidents combined.

When Obama took office January 20, 2009, the national debt was $10.626T(!). As of September 30, 2016, the national debt was estimated to be $19.4T. So it is accurate to say that, while Obama has been in office, the national debt has increased $9.2T, nearly doubling(!). By definition that isn't as much as all previous presidents combined ($10.626T) so this claim is FALSE.

Of course, that's a pretty goofy yardstick against which to be measuring anyway since inflation and GDP influence the relative magnitude of the debt over time and some presidents have even reduced the debt with budget surpluses. Still, it's worthwhile to take a look at our federal debt as one indicator of our governmental spending/health. After all, $9.2T is still an epic amount of debt to accrue over 7 2/3 years.

It's not entirely fair to chalk the entire $9.2T up to Obama, though, because each president inherits the budget of the previous president during his first 9 months in office. A fairer comparison is to look at the sum of budgetary surpluses an deficits for which the president (and Congress) have been responsible. A good summary of Obabma's deficits pegs him as presiding over ~$7T in deficits - still a record by far and ~2x that of his predecessor, W, who presided over ~$3T of deficits.

Since the President and Congress negotiate the budget together each year, it is perhaps even more instructive to look at the costs of a President's specific policies. According to this quora post, Obama's policies have cost ~$1T (The bailout and extending W's tax cuts were his biggest ticket items.), significantly less than Bush's ~$5T (Tax cuts and wars were his biggest ticket items.):

Rather than looking at debt in absolute $ values (which will necessarily increase with inflation), I think it's more useful to contexualize debt as a percentage of GDP - which, alarmingly - is nearing historic (WWII) levels:

CONCLUSION: Obama has contributed to the increase in debt as a percentage of GDP - but so has Reagan, Bush-41, and Bush-43. Surprisingly, Bill Clinton is the only president to have presided over a debt that did not increase dramatically as a percentage of GDP. No matter who the next president is, he/she and Congress need rein in the budget rather than mortgaging everyone's future to do popular things in hopes of reelection.

2016-10-31

2016-10-30

Has the Labor Market Tanked Under Obama?

As part of my series analyzing the article suggesting that Obama has changed the economy for the worse, let's now move on to the third claim: the labor participation rate is near a 40-year low (with the implication that this is an indicator of an unhealthy labor market).

Indeed, according to the Bureau of Labor Statistics, the current Civilian Labor Participation Rate is 62.9%.

Over the last year we've hovered around the lowest value for this metric since 1978. The metric peaked in 1999 and has been slowly declining since then - so we can rate the letter of this claim TRUE - but let's evaluate the spirit of this claim (that our declining labor participation rate is an indicator of an unhealthy labor market) by examining what this metric even means.

Civilian Labor Force Participation Rate == (# employed + # unemployed-and-looking) / (population 16 and older)

so it basically measures the percentage of the work-eligible population that either has a job or is actively looking for one - sounds reasonable enough. However, some portions of the population aren't ones we really care about looking for jobs - students, for example, so the calculation can be further broken down to:

(# employed + # unemployed-and-looking) / (# employed + #unemployed-and-looking + # in school + #unemployed-and-not-looking)

And of those not looking for work, there again are some we don't really care about (at least to assess the health of the job market - retirees, for example:

(# employed + # unemployed-and-looking) / (# employed + #unemployed-and-looking + in school + retired + #unemployed-and-not-looking-and-in-prime-working-age)

And then even some people who are of prime working age but not looking for jobs may deliberately have taken themselves off the job market - stay at home parents, for example:

(# employed + # unemployed-and-looking) / (# employed + #unemployed-and-looking + in school + retired + stay at home parents + #unemployed-and-not-looking-and-in-prime-working-age-and-not-a-stay-at-home-parent)

You can see how a lot of nuance gets lost in a big, hairy, single metric - and finding detailed data for each of those subcomponents is hard.

The BLS projections through 2024 has some decent tabular data and the St. Louis Fed has some good analysis/projections as well. This White House report has much more detail (including on some trends in specific minority segments) but may be biased to make the administration look good.

The best nonpartisan anlysis I found is an article at FiveThirtyEight. TL;DR: about half of the decline in labor participation rate can be explained by demographic trends (baby boomers retiring) and has been expected/predicted for decades. The youngest segment is attending school at a higher rate than ever but isn't large enough to move the needle much on this metric. There may be 2-4 million people without jobs that are attributable to a weak economy rather than to demographic trends that began long before Obama took office.

CONCLUSION: it is misleading to point to the labor participation rate as if it's a dire indicator of a terrible economy; metrics like harmonised unemployment rate (currently 6.17%) are more useful. Still, there is certainly room for improvement in our job market and this should be a focus of our next administration. HOW best to stimulate that job market (and with the right kinds of jobs) is, of course, up for debate.

P.S. Given the rate at which the basic tasks of maintaining society are being automated, I think we need to prepare to look beyond jobs as a success metric for the economy - but that is a separate topic!

Indeed, according to the Bureau of Labor Statistics, the current Civilian Labor Participation Rate is 62.9%.

Over the last year we've hovered around the lowest value for this metric since 1978. The metric peaked in 1999 and has been slowly declining since then - so we can rate the letter of this claim TRUE - but let's evaluate the spirit of this claim (that our declining labor participation rate is an indicator of an unhealthy labor market) by examining what this metric even means.

Civilian Labor Force Participation Rate == (# employed + # unemployed-and-looking) / (population 16 and older)

so it basically measures the percentage of the work-eligible population that either has a job or is actively looking for one - sounds reasonable enough. However, some portions of the population aren't ones we really care about looking for jobs - students, for example, so the calculation can be further broken down to:

(# employed + # unemployed-and-looking) / (# employed + #unemployed-and-looking + # in school + #unemployed-and-not-looking)

And of those not looking for work, there again are some we don't really care about (at least to assess the health of the job market - retirees, for example:

(# employed + # unemployed-and-looking) / (# employed + #unemployed-and-looking + in school + retired + #unemployed-and-not-looking-and-in-prime-working-age)

And then even some people who are of prime working age but not looking for jobs may deliberately have taken themselves off the job market - stay at home parents, for example:

(# employed + # unemployed-and-looking) / (# employed + #unemployed-and-looking + in school + retired + stay at home parents + #unemployed-and-not-looking-and-in-prime-working-age-and-not-a-stay-at-home-parent)

You can see how a lot of nuance gets lost in a big, hairy, single metric - and finding detailed data for each of those subcomponents is hard.

The BLS projections through 2024 has some decent tabular data and the St. Louis Fed has some good analysis/projections as well. This White House report has much more detail (including on some trends in specific minority segments) but may be biased to make the administration look good.

The best nonpartisan anlysis I found is an article at FiveThirtyEight. TL;DR: about half of the decline in labor participation rate can be explained by demographic trends (baby boomers retiring) and has been expected/predicted for decades. The youngest segment is attending school at a higher rate than ever but isn't large enough to move the needle much on this metric. There may be 2-4 million people without jobs that are attributable to a weak economy rather than to demographic trends that began long before Obama took office.

CONCLUSION: it is misleading to point to the labor participation rate as if it's a dire indicator of a terrible economy; metrics like harmonised unemployment rate (currently 6.17%) are more useful. Still, there is certainly room for improvement in our job market and this should be a focus of our next administration. HOW best to stimulate that job market (and with the right kinds of jobs) is, of course, up for debate.

P.S. Given the rate at which the basic tasks of maintaining society are being automated, I think we need to prepare to look beyond jobs as a success metric for the economy - but that is a separate topic!

2016-10-29

Has Obama Implemented A High Number of Major Regulations?

As part of my series analyzing the article suggesting that Obama has changed the economy for the worse, let's now move on to the second claim: Obama has implemented 600 major regulations (regulations expected to have an impact of $100M or more), many more than W's 426, and is on track to implement 641 in total by the end of his presidency. These major regulations cost, on average, $1.4B each.

Let's look into each of these aspects of the claim in turn. My source for most of this analysis is a report by the Congressional Research Service entitled Counting Regulations: An Overview of Rulemaking, Types of Regulations, and Pages in the Federal Register.

1. Obama has implemented 600 major regulations.

This is easy enough to verify from the report:

From 2008 to 2015 there have been 570 major regulations implemented. 570 is less than 600 so this claim is FALSE. (Alternatively, perhaps the author was counting rules enacted so far in 2016, which are not included in this report.)

2. W implemented only 426 regulations (We'll assume the author meant major regulations.)

From 2001 to 2008 there were 505 major regulations implemented. 505 is greater than 426 so this claim too is FALSE.

Perhaps a more fair comparison would be Obama's number vs. W's major regulations just in his first seven years, in which case we would be looking at Obama 570 - W 410.

3. These major regulations cost, on average, $1.4B each.

As of the most recent congressional report, the previous 10 years worth of regulations (667 major rules in total) are expected to provide $261B-$981B in economic benefit at a cost of $68B-$103B so I can't see how Obama's 570 rules are costing $1.4B each - even before you factor in expected economic benefit - so I rate this claim FALSE.

4. Obama is on track to implement 641 major regulations in total by the end of his presidency.

Here the author has simply taken Obama's yearly major regulation average (81) and added it to his seven-year tally (570). 81 is also the median number of major regulations per year under Obama so I think this is a reasonable estimate of his final tally - although it would be more accurate to look at his actual proposed regulations instead. This claim is NOT FALSE but it isn't strong enough to be TRUE.

CONCLUSION: Looking at the # of major regulations since 1997, it has consistently been 50-80 per year (~half of which are simply transfer rules, implementing Congress's budgetary requirements) and Obama mostly stayed within that range. However, he is definitely averaging more regulations per year than W (and more than Clinton's second term) although it isn't evident to me whether that is because Obama is Mr. Big Government (as he is being painted by the author) or whether that has been his only tool to deal with an obstructionist Congress.

Let's look into each of these aspects of the claim in turn. My source for most of this analysis is a report by the Congressional Research Service entitled Counting Regulations: An Overview of Rulemaking, Types of Regulations, and Pages in the Federal Register.

1. Obama has implemented 600 major regulations.

This is easy enough to verify from the report:

From 2008 to 2015 there have been 570 major regulations implemented. 570 is less than 600 so this claim is FALSE. (Alternatively, perhaps the author was counting rules enacted so far in 2016, which are not included in this report.)

2. W implemented only 426 regulations (We'll assume the author meant major regulations.)

From 2001 to 2008 there were 505 major regulations implemented. 505 is greater than 426 so this claim too is FALSE.

Perhaps a more fair comparison would be Obama's number vs. W's major regulations just in his first seven years, in which case we would be looking at Obama 570 - W 410.

3. These major regulations cost, on average, $1.4B each.

As of the most recent congressional report, the previous 10 years worth of regulations (667 major rules in total) are expected to provide $261B-$981B in economic benefit at a cost of $68B-$103B so I can't see how Obama's 570 rules are costing $1.4B each - even before you factor in expected economic benefit - so I rate this claim FALSE.

4. Obama is on track to implement 641 major regulations in total by the end of his presidency.

Here the author has simply taken Obama's yearly major regulation average (81) and added it to his seven-year tally (570). 81 is also the median number of major regulations per year under Obama so I think this is a reasonable estimate of his final tally - although it would be more accurate to look at his actual proposed regulations instead. This claim is NOT FALSE but it isn't strong enough to be TRUE.

CONCLUSION: Looking at the # of major regulations since 1997, it has consistently been 50-80 per year (~half of which are simply transfer rules, implementing Congress's budgetary requirements) and Obama mostly stayed within that range. However, he is definitely averaging more regulations per year than W (and more than Clinton's second term) although it isn't evident to me whether that is because Obama is Mr. Big Government (as he is being painted by the author) or whether that has been his only tool to deal with an obstructionist Congress.

2016-10-28

Is the US Economy Becoming Less Free?

In our evaluation of whether the Obama administration has been terrible for the economy, the first claim we will investigate is that US's Index of Economic Freedom is ranked #11, its lowest ever, and its 7th decline in 8 years, dropping it into the second tier of world economies.

I was unfamiliar with the Index of Economic Freedom but, after a little research, discovered that it is a multicomponent rating of major economies by the slightly right-leaning Wall Street Journal and very right-leaning Hertage Foundation. As with any composite metric, the devil is often in the details of the individual subcomponents but let's assume that this is a worthwhile scoring system (at least from the perspective of those who believe in smaller government / less public economic intervention) and dig in.

Indeed, according to both the Wikipedia article and the Heritage Foundation site, the US was ranked #11 worldwide this year, so we can rate this claim as TRUE.

However, the US was ranked #12 in 2015 and 2014 so we can rate the claim that #11 is its worst ranking ever as FALSE.

Given its ranking improvement from 2015 to 2016 and its flat ranking from 2014 to 2015 (as well as 2012 to 2013), we can also rate the claim that the US's ranking has declined seven times in the most recent 8 years as FALSE. (Possibly the author meant to refer to the US's decline in score rather than ranking.)

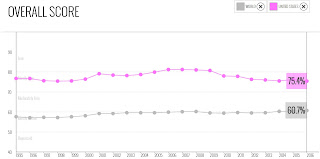

Indeed, the US's decline from a brief high of 81.2% to its current 75.4% does mark a shift from the first tier ("Free") to the second tier ("Mostly Free") so we can rate this claim as TRUE (although the 80% boundary between the two tiers seems to be somewhat arbitrary).

The author is batting .500 in his claims so far but, rather than discrediting him, let's look at the actual data to see what it tells us. From 1995 to 2008 the US's ranking in the Index of Economic Freedom bounced between #4 and #8. From 2012 - 2016 it has bounced between #10 and #12 so there has indeed been a decline in rankings over the course of the Obama administration. What could explain such a decline?

I think we can dismiss #1 as Hong Kong and Singapore have been #1 and #2 respectively ever since the Index of Economic Freedom was first assessed in 1995. If there had been a substantial change in methodology, I suspect that we would have seen a shake-up at the top.

As you can see from the above graph, the average score of other countries has increased modestly over time while the US's is at around the same score it had in 1995. The US's score increased during the Bush administration and has decreased during the Obama administration. Assuming the score responds rapidly to changes in policy and assuming that it isn't just a partisan propaganda machine for its right-leaning benefactors (I don't know how safe either of those assumptions are.), let's dive into its subcomponents to see why the score has fallen in recent years.

CONCLUSION (at least from these metrics): the US government is a little bigger and a little more regulatory than it was under Bush and about the same as it was under Clinton but has not changed much in 21 years. If you believe in smaller government, you won't be thrilled with the US's performance in the Index of Economic Freedom - but it would be hard to point to it as evidence of Obama's total economic failure.

I was unfamiliar with the Index of Economic Freedom but, after a little research, discovered that it is a multicomponent rating of major economies by the slightly right-leaning Wall Street Journal and very right-leaning Hertage Foundation. As with any composite metric, the devil is often in the details of the individual subcomponents but let's assume that this is a worthwhile scoring system (at least from the perspective of those who believe in smaller government / less public economic intervention) and dig in.

Indeed, according to both the Wikipedia article and the Heritage Foundation site, the US was ranked #11 worldwide this year, so we can rate this claim as TRUE.

However, the US was ranked #12 in 2015 and 2014 so we can rate the claim that #11 is its worst ranking ever as FALSE.

Given its ranking improvement from 2015 to 2016 and its flat ranking from 2014 to 2015 (as well as 2012 to 2013), we can also rate the claim that the US's ranking has declined seven times in the most recent 8 years as FALSE. (Possibly the author meant to refer to the US's decline in score rather than ranking.)

Indeed, the US's decline from a brief high of 81.2% to its current 75.4% does mark a shift from the first tier ("Free") to the second tier ("Mostly Free") so we can rate this claim as TRUE (although the 80% boundary between the two tiers seems to be somewhat arbitrary).

The author is batting .500 in his claims so far but, rather than discrediting him, let's look at the actual data to see what it tells us. From 1995 to 2008 the US's ranking in the Index of Economic Freedom bounced between #4 and #8. From 2012 - 2016 it has bounced between #10 and #12 so there has indeed been a decline in rankings over the course of the Obama administration. What could explain such a decline?

- a change in ranking methodology

- a rise in the scores of other countries

- a decline in the US's score

I think we can dismiss #1 as Hong Kong and Singapore have been #1 and #2 respectively ever since the Index of Economic Freedom was first assessed in 1995. If there had been a substantial change in methodology, I suspect that we would have seen a shake-up at the top.

As you can see from the above graph, the average score of other countries has increased modestly over time while the US's is at around the same score it had in 1995. The US's score increased during the Bush administration and has decreased during the Obama administration. Assuming the score responds rapidly to changes in policy and assuming that it isn't just a partisan propaganda machine for its right-leaning benefactors (I don't know how safe either of those assumptions are.), let's dive into its subcomponents to see why the score has fallen in recent years.

- Business Freedom: A country's freedom from the burden of regulations on starting, operating, and closing business, given factors such as time, cost and number of procedures, as well as the efficiency of government in the regulatory process.

- This subcomponent is in line with historic averages - although there was a big blip upward in 2006, possibly due to a methodology change.

- Trade Freedom: Freedom from sizeable numbers and burdens of tariffs and non-tariff barriers to imports and exports of a country.

- This subcomponent has steadily improved.

- Fiscal Freedom: How free is a country from tax burden. It comprises three quantitative measures: top marginal tax rate of both individual (1) and corporate (2) income, and total tax burden as a percentage of GDP (3).

- This subcomponent has been flat while the rest of the world has improved.

- Government Size/Spending: Governments' expenditures as a percentage of GDP, including consumption and transfers. The higher the percentual spending, the lower the score.

- This subcomponent has decreased since 9/11 but has increased again since 2012.

- Monetary Freedom: How free from microeconomic intervention and price instability is a country, basing on an equation considering the weighted average inflation rate in the last three years and price controls.

- This subcomponent has decreased over time.

- Investment Freedom: Freedom from restrictions on the movement and use of investment capital, regardless of activity, within and across the country's borders.

- This subcomponent has been flat except for a blip up during the late 2000s.

- Financial Freedom: A country's independence from government control and interference in the financial sector, including banks. It considers government ownership of financial firms, extent of financial and capital market development, government influence on the allocation of credit and openness to foreign competition.

- This subcomponent has been flat except for a blip up during the Bush administration.

- Property Rights: Degree of a country's legal protection of private property rights, degree of enforcement of those laws, independence of and corruption within the judiciary, and likelihood of expropriation.

- This subcomponent has slightly decreased over time - along with the rest of the world.

- Freedom from Corruption: The non-prevalence of political corruption within a country, according to the Corruption Perceptions Index.

- This subcomponent has been flat since 1997.

- Labor Freedom: How free is a country from legal regulation on the labor market, including those relating to minimum wages, hiring and firing, hours of work and severance requirements.

- This subcomponent has been flat but took a big dive this year (not sure why).

CONCLUSION (at least from these metrics): the US government is a little bigger and a little more regulatory than it was under Bush and about the same as it was under Clinton but has not changed much in 21 years. If you believe in smaller government, you won't be thrilled with the US's performance in the Index of Economic Freedom - but it would be hard to point to it as evidence of Obama's total economic failure.

2016-10-27

Has Obama Changed the Economy for the Worse?

A friend of mine posted an article that presents many arguments for the complete failure of the Obama administration's economy. Some of the claims seemed pretty hyperbolic and much of the "evidence" seemed dubious but I thought they were worth reviewing anyway. Over the next several posts I will investigate the following claims made in the article:

- Index of Economic Freedom: #11, lowest global ranking, 7th decline in 8 years, dropped to the second tier in 2010. We'll also want to look into the components of this index and the US's score/ranking since 1995 if we can.

- Obama has implemented 600 MAJOR regulations ($100m+ impact), on track to implement 641 more, many more than the 426 implemented by W, costing $1.4B each

- Labor participation rate near 40-year low (including record number of women) and implication that that is an indicator of an unhealthy economy. Here we'll want to break down LPR into components and understand what's driving it - is it joblessness, or retirees?

- Obama accrued more debt than every other president before him combined. Here I'm especially interested in how much of that figure is attributable to Obama (or any president).

- 46M Americans living in poverty

- Nearly 50M Americans on SNAP (food stamps)

- Record number of home foreclosures during Obama's presidency. Here I'm interested to see if this is a real Obama phenomenon (and, if so, why?) or if most of these are leftover from the 2007-2009 mortgage crisis.

- America's credit rating downgraded for the first time ever. Here again I'm also interested in how much Obama might have to do with that.

- Trust in Obama's leadership and administration remains at historically low levels.

After that it's all a bunch of unsubstantiated, subjective claims that will be much harder to validate or refute - but I think the above list gives us plenty to work with!

2016-10-07

Jimmy Buffett the Storyteller

This weekend I took a quick trip to Paris to attend my 18th and 19th Jimmy Buffett concerts - my 9th year of seeing him in Europe! As per usual, it was a tiny venue and the concerts were very intimate - just Jimmy and several hundred fans. After a full day of tailgating (with champagne - a' la Parisienne!), I pondered a bit why exactly I'm so fond of Buffett and his concerts.

Although Jimmy Buffett's brand of music has defied categorization for more than 40 years, it is often referred to as "island escapism." He sings about sailing, carousing, and living the carefree lifestyle of - in his words - "a beach bum, a man for all seasides." So one hypothesis would be that I am attracted to that escapism as a temporary relief from the hustle and bustle of running a company. Indeed, when my mom first got into Buffett music (and, in turn, got me into it), it was in the context of sailing and beaching in the US Gulf Coast and Caribbean. A great deal of Buffett's music does transport me to my memories the islands so there may be something to the escapism (and nostalgia, to boot) explanation - a "journey" to the Caribbean without all the hassle - but I don't think tells the full story.

Another hypothesis would be that it is Buffett's music per se that really speaks to me. His blend of folk, country, rock and roll, reggae, and island styles is certainly both unique and interesting. However, while he does have several songs that I love musically, most of his music I would describe as good-not-great (and some of it is straight up formulaic). Jimmy himself has declared in interviews that he isn't a particularly gifted musician per se so, here again, I think we have to look further.

The answer lies in Buffett's lyrics. Although he does have some songs that are quite banal ("Why Don't We Get Drunk and Screw," anyone?) the majority of his work features clever lyrics, vivid imagery, and double meanings. Not only are such lyrics refreshing in a day and age of dumbed down popular music, they make for much more interesting songs as well.

One lyrical device that Buffett often employs is the evolving chorus - the chorus of each verse changes subtly so that, over the course of the song, a story is told. And this, I think, is really the crux of Buffett's appeal: he's a storyteller.

Much as Bob Dylan was a poet who happened to present his poetry through music, Jimmy Buffett is a storyteller who happens to tell his stories through music (though he certainly drew on the same talent to become a best-selling fiction author). While Buffett himself has lived the lifestyle about which he sings for decades, most of his songs aren't actually autobiographical (I remember doing the math for the first time and realizing that he wrote "A Pirate Looks at 40" when he was still in his 20s so it must have been about someone else!) but are inspired by the many characters he has met along the way. Jimmy Buffett is a bard - a beach bard!

From the dawn of human history we have used stories to connect with one another and this, I'm sure, is why so many people are compelled by Buffett's music. In his stories different people find different elements that speak to them, connecting them to his music - and to each other. That's why a Buffett concert is such a melange of diverse people from all walks of life - we're all so different but the stories connect us together.

That's also why the best part of any Buffett concert is the tailgate; it's a full day of spending time with others who share that same connection - often sharing relevant stories of our own. The concert itself is invariably one big sing-a-long. Even if you don't know the people around you, singing the same songs at the tops of your lungs brings you together.

These Parisian Buffett concerts have been such tremendous experiences over the last decade. I've had the opportunity to share them with some of my dearest family and friends - and to make new friends along the way. Thanks, Jimmy, for all the stories, both those in your music and those new ones we've been creating at your concerts!

Although Jimmy Buffett's brand of music has defied categorization for more than 40 years, it is often referred to as "island escapism." He sings about sailing, carousing, and living the carefree lifestyle of - in his words - "a beach bum, a man for all seasides." So one hypothesis would be that I am attracted to that escapism as a temporary relief from the hustle and bustle of running a company. Indeed, when my mom first got into Buffett music (and, in turn, got me into it), it was in the context of sailing and beaching in the US Gulf Coast and Caribbean. A great deal of Buffett's music does transport me to my memories the islands so there may be something to the escapism (and nostalgia, to boot) explanation - a "journey" to the Caribbean without all the hassle - but I don't think tells the full story.

Another hypothesis would be that it is Buffett's music per se that really speaks to me. His blend of folk, country, rock and roll, reggae, and island styles is certainly both unique and interesting. However, while he does have several songs that I love musically, most of his music I would describe as good-not-great (and some of it is straight up formulaic). Jimmy himself has declared in interviews that he isn't a particularly gifted musician per se so, here again, I think we have to look further.

The answer lies in Buffett's lyrics. Although he does have some songs that are quite banal ("Why Don't We Get Drunk and Screw," anyone?) the majority of his work features clever lyrics, vivid imagery, and double meanings. Not only are such lyrics refreshing in a day and age of dumbed down popular music, they make for much more interesting songs as well.

One lyrical device that Buffett often employs is the evolving chorus - the chorus of each verse changes subtly so that, over the course of the song, a story is told. And this, I think, is really the crux of Buffett's appeal: he's a storyteller.

Much as Bob Dylan was a poet who happened to present his poetry through music, Jimmy Buffett is a storyteller who happens to tell his stories through music (though he certainly drew on the same talent to become a best-selling fiction author). While Buffett himself has lived the lifestyle about which he sings for decades, most of his songs aren't actually autobiographical (I remember doing the math for the first time and realizing that he wrote "A Pirate Looks at 40" when he was still in his 20s so it must have been about someone else!) but are inspired by the many characters he has met along the way. Jimmy Buffett is a bard - a beach bard!

From the dawn of human history we have used stories to connect with one another and this, I'm sure, is why so many people are compelled by Buffett's music. In his stories different people find different elements that speak to them, connecting them to his music - and to each other. That's why a Buffett concert is such a melange of diverse people from all walks of life - we're all so different but the stories connect us together.

That's also why the best part of any Buffett concert is the tailgate; it's a full day of spending time with others who share that same connection - often sharing relevant stories of our own. The concert itself is invariably one big sing-a-long. Even if you don't know the people around you, singing the same songs at the tops of your lungs brings you together.

These Parisian Buffett concerts have been such tremendous experiences over the last decade. I've had the opportunity to share them with some of my dearest family and friends - and to make new friends along the way. Thanks, Jimmy, for all the stories, both those in your music and those new ones we've been creating at your concerts!

Subscribe to:

Posts (Atom)